How home rentals are dominating pandemic travel: Rakuten Intelligence research

Travel ranks at the top of the industries hardest hit by the coronavirus. Business trips essentially halted entirely, government-mandated travel bans curtailed overseas summer vacations and quarantine restrictions disrupted inter-state travel. This amidst mounting public fears of bustling through crowded airports, sitting for hours in close quarters and fears of the virus being pumped in by recycled air.

There is a silver lining for the U.S. lodging industry though. While airlines have endured the brunt of the impact and overall Lodging dollars are down by 33 percent from April-July this year compared to last, Home Rental services are bucking the trend — up 22 percent for the same period.

Note: For this post, all comparisons take place from the period of April to July in the U.S., unless specified otherwise.

In April through July 2019, the average home rental cost was $437 more than a hotel, and in 2020 that number grew to $772.

Home Rentals are Up

Across all lodging, the share of dollars spent on home rentals has increased from 33 percent in 2019 to 60 percent in 2020, now accounting for more than half of all lodging spend. The amount spent per home rental reservation increased almost 40 percent, due to longer stays and increases in pricing. Still, the number of home rental reservations is actually down 11 percent from the same period in 2019, but a far cry better than the overall category, which saw reservations down 45 percent.

Part of the category growth can be attributed to an influx in “new buyers” — or people who hadn’t made a prior booking during the tracked period (2018-2020) — 42 percent of Airbnb’s buyers had never made an Airbnb reservation before, while 20 percent of overall lodging buyers had never made a lodging reservation.

As people avoid airline travel and seek closer-to-home getaways (out-of-state reservations are down 41 percent YoY), they are venturing away from busy cities and hotel stays. Instead of opting for locations near top-rated restaurants, entertainment and activities, they’re looking for cottages with kitchens near water and outdoor adventuring. They want amenities that are compatible with long-term stays and a much-needed change of scenery from quarantining, which is proving good news for property owners, managers and services like VRBO and Airbnb.

Meanwhile, hotels remained relatively the same.

Longer Stays

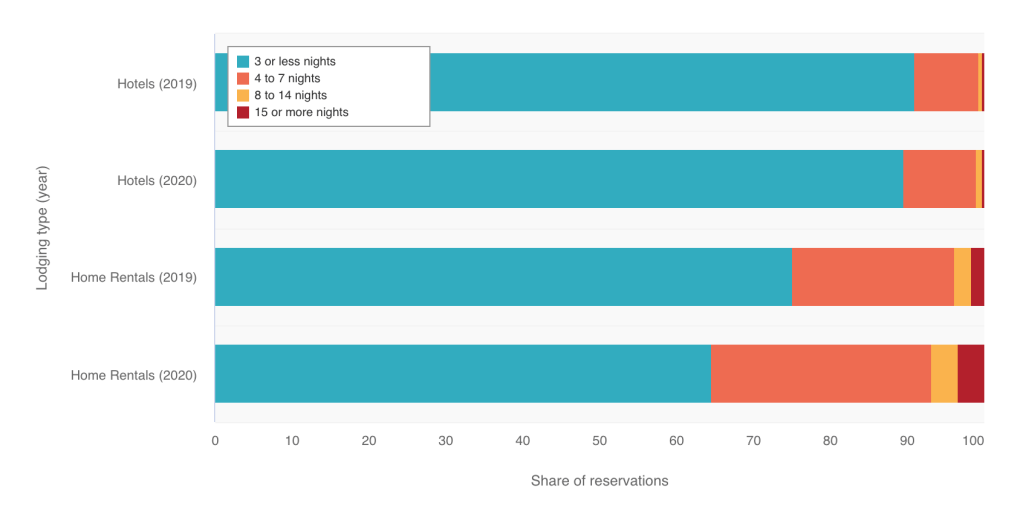

The increase in home rental spending is indicative of another coronavirus trend — people are booking longer stays. The average length of a home rental reservation increased by a full day this year. The share of home rentals lasting four to seven nights increased by 8 percentage points, and, for Airbnb specifically, the number of reservations for 15 or more nights was 9 percent in April 2020 versus just 2 percent in April 2019. However, this trend hasn’t translated to hotels, which remain relatively flat.

More and more, as quarantining drags on, people are looking for alternatives to their own four walls. They aren’t just booking vacations to fill their time off — they’re reserving a place where they can work remotely. This lends itself to more extended stays, without the expectation of being back in the office.

Until April 2020, the average number of days home rental reservations were placed before check-in was noticeably higher than hotels.

Impulse Travel

With the pandemic’s initial uncertainty, consumers increased the average number of days they planned ahead for travel. Lodging reservations were booked almost 20 percent further out (44 days) in April than they were in March (38 days) — the longest average advance booking in the past two years. As the reality of the long-term impacts set in, and the quarantine walls started closing in, the advanced booking window began to shorten. By May, the average advanced booking time was down to 30 days, then to 24 days in June and 20 days in July (less than half of April’s peak). While previous years saw a similar downward trend going into the summer, the percent of Airbnb reservations that were booked within one week of the stay went up in 2020 — 35 percent in March (11 percent more than 2019), 43 percent in April (19 percent more than 2019) and 34 percent in May (9 percent more than 2019).

This trend is consistent for hotels as well. July hotel bookings in 2019 occurred an average of 24 days in advance versus just 17 in 2020, with the percentage of bookings placed less than a week in advance growing from 50 percent to 62 percent.

About the data

With a panel of more than a million online shoppers, Rakuten Intelligence gives the most detailed, and accurate digital commerce data available, and is reported daily.

Rakuten Intelligence is the only service to measure digital commerce directly from the consumer, across all retailers, at the item level, and over time. Our retailer-independent methodology precisely measures commerce as it happens. By extracting detailed information from hundreds of millions of aggregated and anonymized e-receipts, Rakuten Intelligence can map the entire Purchase Graph, connecting each and every consumer to all their purchases.

Rakuten Intelligence gets its data from e-receipts — not a browser, app or software installed by the end-user — so its measurement reflects comprehensive shopping behavior across multiple devices, over time, which are key in an increasingly omnichannel retail world.

Originally published by Rakuten Intelligence in The Brief Blog, here.